Key Features

TW Finance Partners

DLL Financial Solutions Partner: Offers tailored forklift financing solutions to meet your business needs, including leasing, refinancing, and purchasing options for new or used equipment. With flexible terms and a focus on customer satisfaction, DLL helps you manage your fleet and preserve working capital. LEARN MORE

Verdant Commercial Capital: Offers flexible financing options for forklift purchases and leases, including short and long-term plans to fit your cash flow needs. Their customer-first approach ensures easy access to funding for new or used forklifts, with tailored solutions and quick turnaround times. LEARN MORE

Wells Fargo: Offers a wide range of financing and leasing solutions to help you conserve capital and support your business objectives. Their customer-first approach ensures easy access to funding for new or used forklifts, with tailored solutions and quick turnaround times to simplify the financing process. LEARN MORE

Explore Our Financing Options

Forklift financing isn’t a one-size-fits-all solution. At Total Warehouse, we offer flexible terms and options to suit your needs:

- Fair Market Value (FMV): Choose financing based on the forklift’s market value.

- $1 Option Lease: Lease a forklift with the option to buy it for $1 at the term’s end.

- Lease/Rent-to-Own: Make payments toward owning the forklift at end of the lease.

- Long-Term Rental: Lease a forklift for extended periods.

- 24–76 Month Terms: Choose the length of the financing agreement for your needs.

Advantages of Forklift Financing

Choosing to finance your forklift offers several advantages, including:

- Tax Deductions: With the Section 179 tax deduction rule, businesses may be able to deduct the cost of their forklifts, making the equipment more affordable.

- Fixed Monthly Payments: Enjoy predictable monthly payments that make it easier to plan and budget.

- Increased Working Capital: Financing helps preserve your cash flow, giving you more capital to invest in other areas of your business.

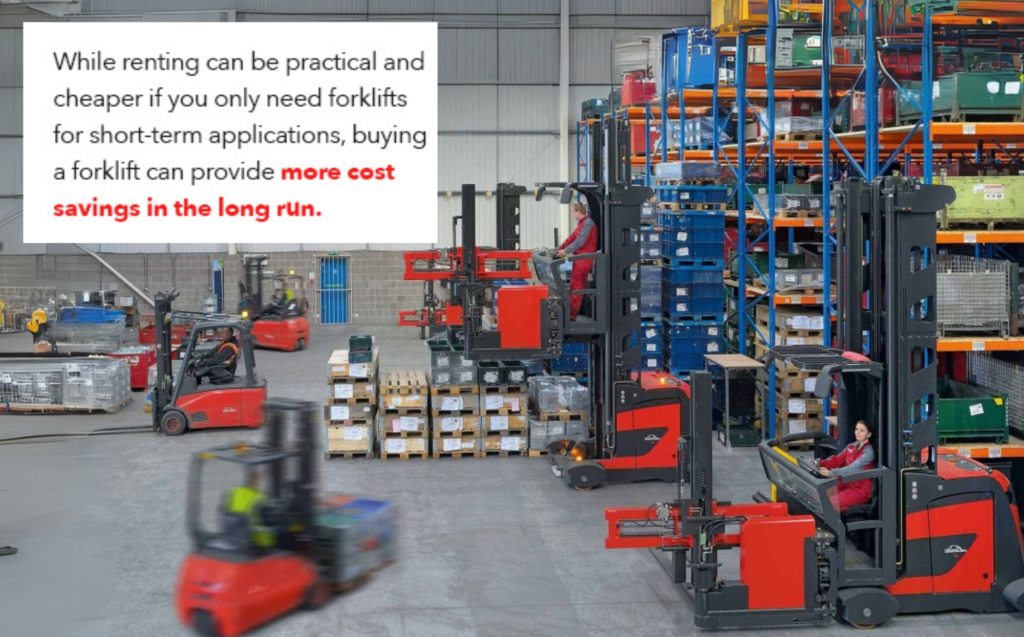

Making The Best Choice For Your Business

Deciding whether to rent, lease, or buy a forklift depends on several factors, including your budget, operational needs, and long-term goals. Here’s a quick recap to help guide your decision:

Buy a Forklift for long-term, consistent equipment needs, want ownership and resale value, and can handle the upfront costs and ongoing maintenance.

Rent a Forklift for short-term flexibility, easy budgeting, and maintenance-free operation for cyclical or unpredictable business demands.

Lease a Forklift for access to the latest equipment without a large capital investment, reduced maintenance costs, and affordable monthly payments over a few years.

Each option has its strengths, and the best choice will depend on your specific business requirements. Whichever path you choose, Total Warehouse can help ensure you maximize the value of your equipment investment.

Total Forklift Financing

Flexible Financing Options

Not sure which financing option suits your needs? Our experienced financing team is here to help. We provide financing for all of our equipment. With over 50+ years of expertise, we’re ready to answer your questions quickly and thoroughly. Get the insights you need to confidently choose the best financing solution for your business.

Trusted Finance Partners

Flexible Financing Terms

Explore Total Warehouse's flexible forklift financing partners and options tailored to your needs for purchasing new or pre-owned equipment. Financing Partners include Wells Fargo, DLL Financial Solutions Partner, Verdant Commercial Capital, and more.

Financing Options

- Fair Market Value (FMV)

- $1 Option Lease

- Lease/Rent-to-Own

- Long-Term Rental

- 24–76 Month Terms

Still not convinced?

Let us help you decide.

The warehouse experts at TOTAL WAREHOUSE have decades of experience with every type of industry and operation. We know the exact equipment and storage system combination needed to increase your output. Give us a call and let's grow your business together.